Eth And Btc Market Cap Insights And Trends Examined

Kicking off with eth and btc market cap, the cryptocurrency landscape has captured the attention of investors and enthusiasts alike. As Bitcoin and Ethereum continue to dominate the market, understanding their market capitalization becomes crucial for making informed decisions.

This exploration delves into what market capitalization means in the crypto world, its significance for both ETH and BTC, and how these figures influence investment strategies and market perceptions.

Market Capitalization Overview

Market capitalization, commonly referred to as market cap, is a critical metric used in the cryptocurrency space to assess the total value of a cryptocurrency. It is calculated by multiplying the current price of the asset by its circulating supply. For cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), understanding market cap is essential as it reflects their relative size, influence, and market dynamics.

For instance, if Bitcoin is currently priced at $60,000 and has a circulating supply of 18 million BTC, the market cap would be calculated as follows: $60,000 x 18,000,000 = $1,080,000,000,000 (or $1.08 trillion). This figure provides insight into Bitcoin’s dominance within the crypto market and allows investors to compare it with Ethereum and other cryptocurrencies.

ETH vs BTC Market Cap Comparison

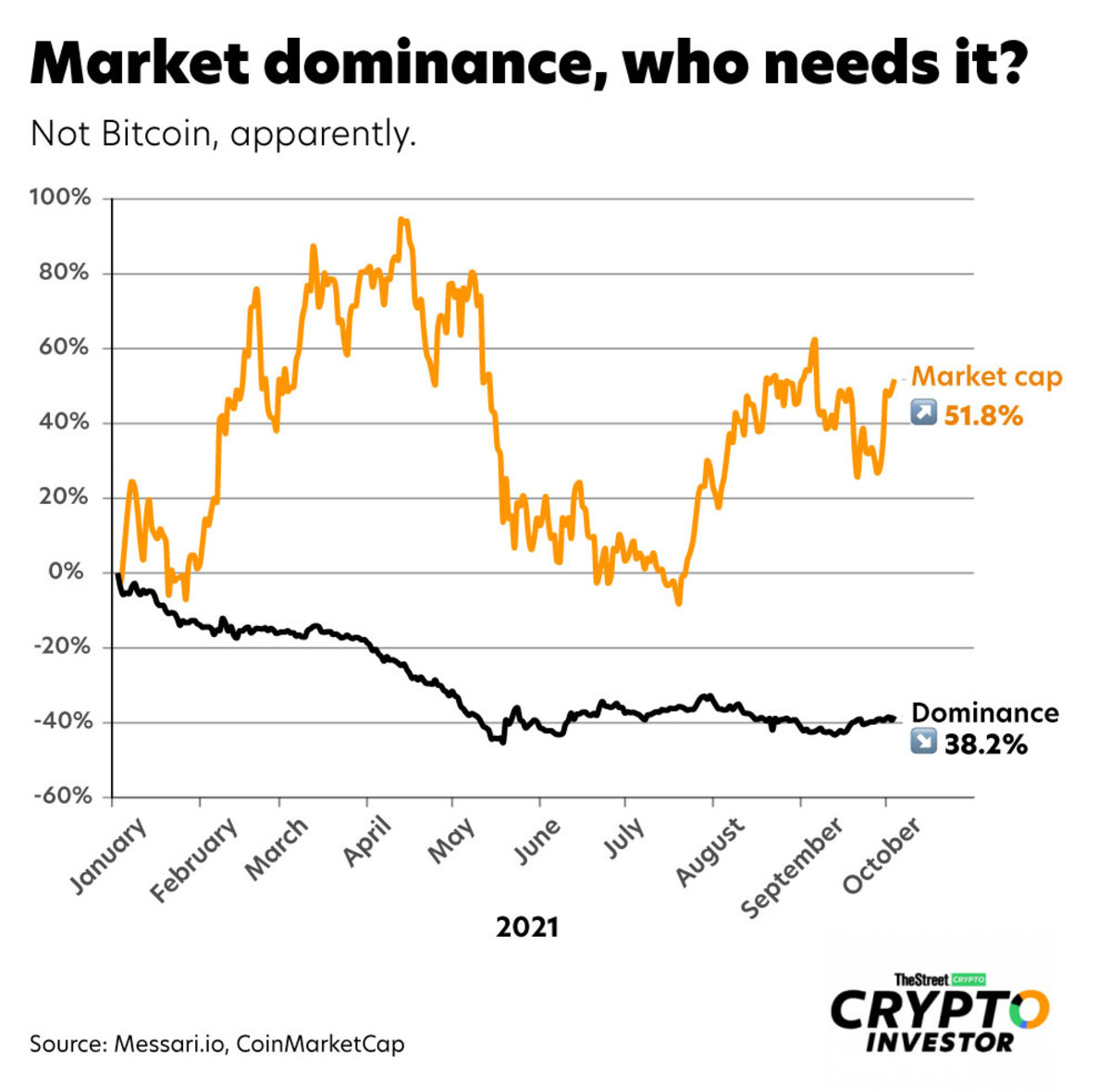

As of now, Bitcoin maintains a significantly higher market cap compared to Ethereum. While Bitcoin’s market cap hovers around $1.08 trillion, Ethereum’s market cap is around $230 billion. This stark difference illustrates Bitcoin’s status as the leading cryptocurrency, but it’s important to note the trends in market cap growth. Over the past year, Bitcoin has seen fluctuations in its market cap due to various factors such as regulatory news and market sentiment.

In contrast, Ethereum has demonstrated more pronounced growth, particularly following the surge in decentralized finance (DeFi) applications and the rise of non-fungible tokens (NFTs). Factors contributing to these changes include:

- The introduction of Ethereum 2.0, enhancing scalability and security.

- Institutional interest and investment in both cryptocurrencies.

- Market speculation and the overall economic climate impacting investor behavior.

Historical Market Cap Trends

Historically, both Bitcoin and Ethereum have experienced significant milestones in their market capitalization. Bitcoin first surpassed the $1 billion market cap mark in late 2013, while Ethereum achieved a market cap of $1 billion in early

2016. Key events that impacted their market caps include

- The Bitcoin fork in 2017, which led to the creation of Bitcoin Cash.

- Market crashes, such as the one in 2018, which drastically affected asset valuations.

- The explosion of DeFi and NFTs in 2020 and 2021, which significantly boosted Ethereum’s market cap.

This timeline of events highlights that market cap is not just a static figure; it is influenced by a myriad of factors that can drastically alter valuations.

Market Cap and Investment Decisions

Market capitalization plays a vital role in shaping investment strategies for both ETH and BTC. Investors often use market cap as a barometer for risk assessment. Generally, assets with larger market caps are perceived as less risky compared to those with smaller market caps due to their established market presence and liquidity. Understanding the relationship between market cap and price volatility is essential.

Generally, cryptocurrencies with lower market caps can experience more significant price swings, as a smaller amount of capital can lead to larger percentage changes. Thus, potential investors should consider:

- The stability and maturity of the asset.

- Market trends and investor sentiment.

- Any upcoming events or news that could influence market dynamics.

Future Market Cap Predictions

Future predictions for ETH and BTC market caps largely hinge on current market trends and technological advancements. With Ethereum’s transition to a Proof of Stake model and ongoing upgrades, its market cap could potentially see significant growth if adoption continues. Conversely, Bitcoin’s market cap may be influenced by regulatory developments and broader economic conditions. Institutional developments, such as the acceptance of Bitcoin and Ethereum by major financial institutions, could provide substantial boosts to market caps.

Additionally, the role of market sentiment cannot be understated; as investor confidence ebbs and flows, so too will market caps. Scenarios to consider include:

- The potential for Bitcoin ETFs to enhance market visibility and accessibility.

- Emerging technologies like layer-2 solutions for Ethereum to improve scalability.

- Global economic recovery impacting cryptocurrency investment flows.

Global Market Cap in Context

When comparing the market caps of Ethereum and Bitcoin to traditional financial assets, the cryptocurrencies still lag behind entities like gold and major stock indices. Bitcoin’s market cap, while substantial, is still less than that of gold, which is estimated to be over $11 trillion. This comparison provides insight into the potential growth trajectory of cryptocurrencies.The implications of cryptocurrency market cap on the global economy are profound.

As more institutional investments flood into the crypto space, the market cap of digital assets is likely to grow. The involvement of major financial players has already begun to reshape perceptions and influence market dynamics.

Community and Market Cap

Community support and ongoing development are pivotal in shaping the market cap of both Bitcoin and Ethereum. A strong developer community can lead to innovative solutions, driving demand and, consequently, market cap. Critical factors include:

- The frequency and impact of updates and upgrades in the networks.

- The role of community initiatives and governance proposals in decision-making.

- Key events such as hackathons or meetups that foster collaboration and innovation.

This active engagement not only supports price stability but can also enhance market cap through increased adoption and user confidence.

Conclusion

In summary, the discussion around eth and btc market cap reveals not just numbers, but the underlying trends and factors that shape the future of these cryptocurrencies. As the market evolves, staying attuned to these insights will empower investors to navigate the complexities of crypto investments successfully.

Question & Answer Hub

What is market capitalization in cryptocurrency?

Market capitalization is the total value of a cryptocurrency, calculated by multiplying its current price by the circulating supply.

How does market cap affect investment decisions?

A higher market cap often indicates stability and lower risk, while smaller caps can present higher volatility and potential for growth.

What influences changes in market cap for ETH and BTC?

Market cap changes can be influenced by factors such as investor sentiment, technological advancements, and regulatory news.

How do ETH and BTC compare in terms of market cap?

Bitcoin typically has a larger market cap than Ethereum, reflecting its status as the first cryptocurrency and its widespread adoption.

What role does community support play in market cap?

Community engagement and developer activity can significantly impact market cap, as strong support often leads to increased interest and investment.