Ethereum And Bitcoin Which Is Better A Comprehensive Guide

Ethereum and Bitcoin which is better is a hot topic in the cryptocurrency world, sparking debates among investors, tech enthusiasts, and casual users alike. As the two most prominent cryptocurrencies, they each bring unique features and benefits to the table, making it essential to understand their differences and similarities.

From their historical development and technical foundations to their current market performance and future trends, this discussion aims to shed light on the advantages and potential drawbacks of each, helping you make informed decisions whether you are investing, developing, or simply curious about the crypto landscape.

Overview of Ethereum and Bitcoin

Bitcoin and Ethereum are the two most prominent cryptocurrencies in the digital landscape. While Bitcoin was designed as a decentralized digital currency, Ethereum goes a step further by enabling smart contracts and decentralized applications (dApps) on its platform. Both have sparked a technological revolution, attracting a diverse community of developers and investors.Bitcoin was first introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, laying the groundwork for blockchain technology.

In contrast, Ethereum was proposed in late 2013 by Vitalik Buterin and launched in 2015, expanding the capabilities of blockchain beyond currency. The primary use case for Bitcoin is as a store of value and a medium of exchange, while Ethereum serves as a foundation for various applications, including DeFi, NFTs, and more.

Technical Differences

.png)

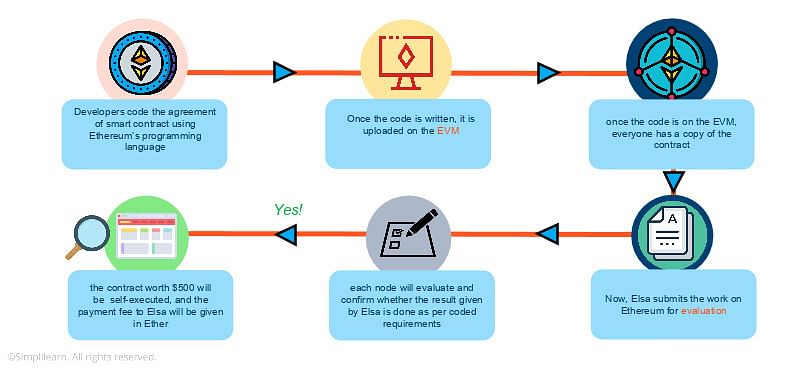

The technological foundations of Bitcoin and Ethereum differ significantly. Bitcoin operates on a simple scripting language designed mainly for financial transactions, while Ethereum uses a more versatile Turing-complete language that allows developers to create complex smart contracts.The consensus mechanisms also vary: Bitcoin utilizes Proof of Work (PoW), which requires miners to solve cryptographic puzzles, whereas Ethereum is in the process of transitioning to Proof of Stake (PoS).

This shift aims to enhance scalability and energy efficiency. In terms of transaction speeds, Bitcoin processes approximately 7 transactions per second, while Ethereum can handle around 30 transactions per second. However, Ethereum’s ongoing developments are aimed at significantly increasing this capacity.

Market Performance

Analyzing the historical price trends of Bitcoin and Ethereum reveals fascinating insights. Since its inception, Bitcoin has experienced dramatic price fluctuations, reaching an all-time high of nearly $69,000 in November 2021. Ethereum, on the other hand, has also seen significant price increases, peaking at around $4,800 during the same period.Both cryptocurrencies boast substantial market capitalizations; Bitcoin consistently leads the market, often valued at over $400 billion, while Ethereum follows closely with a market cap exceeding $200 billion.

Trading volumes also reflect the popularity of both assets, with Bitcoin often seeing higher daily trading activity.Key events such as regulatory announcements, technological upgrades, and market sentiment shifts have played crucial roles in influencing the prices of both Bitcoin and Ethereum. For instance, Bitcoin’s acceptance by institutional investors has sparked bullish trends, while Ethereum’s upgrades, particularly the transition to Ethereum 2.0, have generated significant interest.

Use Cases and Applications

Ethereum’s versatility extends far beyond cryptocurrency. It serves as a platform for various real-world applications, including decentralized finance (DeFi) protocols that offer lending, borrowing, and trading services without intermediaries. Additionally, Ethereum is the backbone of the NFT explosion, enabling the creation and trading of unique digital assets.Comparatively, Bitcoin’s primary function is as a digital gold, attracting investors looking for a hedge against inflation.

Its limited supply and established network make it a solid investment choice.The growing role of DeFi in Ethereum’s ecosystem highlights its potential for disruption in traditional finance, offering innovative solutions that challenge traditional banking practices.

Community and Development

The communities surrounding Bitcoin and Ethereum play a vital role in their development. Bitcoin’s community is often described as conservative, prioritizing security and stability, while Ethereum’s community is known for its innovation and willingness to experiment with new ideas.In terms of development teams, Bitcoin is maintained by a decentralized group of developers, whereas Ethereum has a more organized structure led by the Ethereum Foundation.

Governance structures also differ; Bitcoin implements a more informal consensus for changes, while Ethereum adopts a more structured approach through Ethereum Improvement Proposals (EIPs).Community support has been instrumental in fostering growth for both cryptocurrencies. Bitcoin’s strong following has helped solidify its status as a digital currency leader, while Ethereum’s vibrant developer community continues to push the boundaries of blockchain technology.

Regulatory Considerations

The regulatory environment surrounding Bitcoin and Ethereum has evolved significantly over the years. Governments worldwide are increasingly recognizing the need to establish frameworks for cryptocurrencies, impacting both assets differently.Countries like the United States have implemented regulations that focus on consumer protection and anti-money laundering, which can affect Bitcoin’s use in transactions. In contrast, Ethereum’s DeFi projects face scrutiny regarding regulatory compliance, especially concerning securities laws.Global approaches to cryptocurrency legislation vary widely; some countries embrace cryptocurrencies, while others impose strict regulations.

These regulatory landscapes will undoubtedly shape the future of both Bitcoin and Ethereum, influencing their adoption and use.

Future Trends and Innovations

Looking ahead, potential developments in Bitcoin and Ethereum technology could reshape the cryptocurrency landscape. Bitcoin may see enhancements in scalability through the Lightning Network, which aims to facilitate faster transactions. Ethereum, with its shift to PoS and ongoing upgrades, aims to improve efficiency and reduce energy consumption.Adoption rates for both cryptocurrencies are on the rise, particularly in regions like North America and Asia, where interest in blockchain technology and digital assets is growing rapidly.

Predictions suggest that Bitcoin will maintain its status as a digital store of value, while Ethereum will continue to expand its ecosystem with innovative applications.

Investment Strategies

Investing in Bitcoin and Ethereum requires a strategic approach. Long-term holders often advocate for a buy-and-hold strategy, capitalizing on potential price appreciation over time. Conversely, traders may engage in short-term strategies, taking advantage of market volatility.Each cryptocurrency presents unique risks and rewards. Bitcoin’s price stability and established reputation make it a safer investment, while Ethereum’s innovative potential and market dynamics present higher risk but also higher reward opportunities.To provide a clearer picture, the following table compares key investment performance metrics of Bitcoin and Ethereum:

| Metric | Bitcoin | Ethereum |

|---|---|---|

| Market Capitalization | $400 billion+ | $200 billion+ |

| Price Volatility (1 Year) | High | Very High |

| Transaction Speed | 7 transactions/second | 30 transactions/second |

| Primary Use Case | Store of Value | Smart Contracts & dApps |

Closing Notes

In conclusion, examining Ethereum and Bitcoin which is better reveals that both cryptocurrencies have their own strengths and weaknesses. Bitcoin is often seen as a store of value, while Ethereum offers broader functionalities through smart contracts and decentralized applications. Understanding these facets not only clarifies the ongoing debates but also assists in navigating your own journey within the crypto space.

FAQ Corner

What are the main differences between Bitcoin and Ethereum?

Bitcoin primarily serves as a digital currency and store of value, while Ethereum also facilitates smart contracts and decentralized applications.

Which cryptocurrency has a larger market cap?

As of now, Bitcoin has a larger market cap compared to Ethereum, making it the most valuable cryptocurrency.

Can I use Ethereum for purposes other than trading?

Yes, Ethereum can be used to build decentralized applications, participate in decentralized finance (DeFi), and create non-fungible tokens (NFTs).

How do transaction speeds compare between the two?

Ethereum typically has faster transaction speeds than Bitcoin, but this can vary based on network congestion.

Which cryptocurrency is more environmentally friendly?

Ethereum is transitioning to a proof-of-stake model, which is expected to be more environmentally friendly than Bitcoin’s current proof-of-work model.