btc eth buy Investing in Leading Cryptocurrencies

b tc eth buy opens the door to the fascinating world of cryptocurrency investment, specifically focusing on Bitcoin and Ethereum. These two giants not only lead the market but also serve distinct purposes, attracting a diverse range of investors. Understanding their unique qualities, historical significance, and technological foundations provides a solid starting point for anyone looking to dive into the crypto space.

As the cryptocurrency landscape evolves, having a clear knowledge of BTC and ETH, along with the factors influencing their market dynamics, helps potential buyers make informed decisions. Whether you're a seasoned investor or a curious newcomer, grasping the nuances of these digital currencies can empower you to navigate the complexities of buying and investing in them.

Overview of BTC and ETH

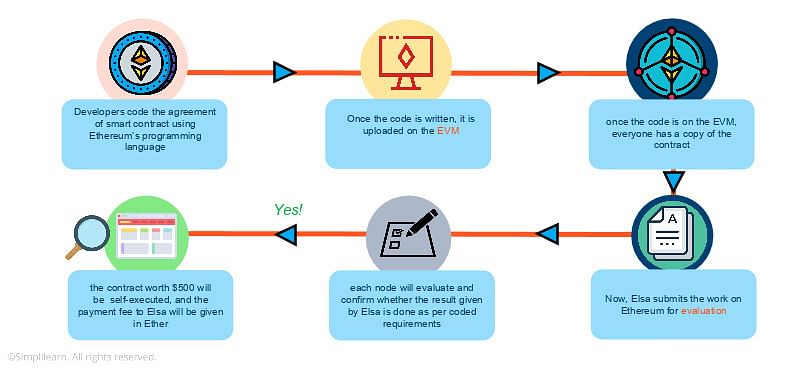

Bitcoin (BTC) and Ethereum (ETH) are the pioneering cryptocurrencies that have shaped the digital currency landscape. Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, was designed as a decentralized digital currency to allow peer-to-peer transactions without the need for intermediaries like banks. Its primary purpose is to serve as a digital gold, a store of value, and a means of transferring wealth securely over the internet.Ethereum, launched in 2015 by Vitalik Buterin and a team of co-founders, introduced a revolutionary platform that allows developers to build decentralized applications (dApps) on its blockchain.

Unlike Bitcoin, which is primarily a currency, Ethereum's purpose extends to enabling smart contracts—self-executing contracts with the terms directly written into code. This functionality has positioned Ethereum as a leader in the decentralized finance (DeFi) space and the non-fungible token (NFT) market.In the cryptocurrency market, both BTC and ETH hold significant value, representing a large portion of the total market capitalization.

Bitcoin remains the dominant cryptocurrency, often regarded as a safe haven asset in the digital realm. In contrast, Ethereum's versatility has spurred innovation and adoption, making it the backbone of numerous blockchain projects and applications.The differences between BTC and ETH are stark, particularly in their use cases and functionalities. Bitcoin is primarily used for transactions and as a store of value, while Ethereum serves as a platform for decentralized applications and smart contracts.

This fundamental difference shapes how investors approach these two assets.

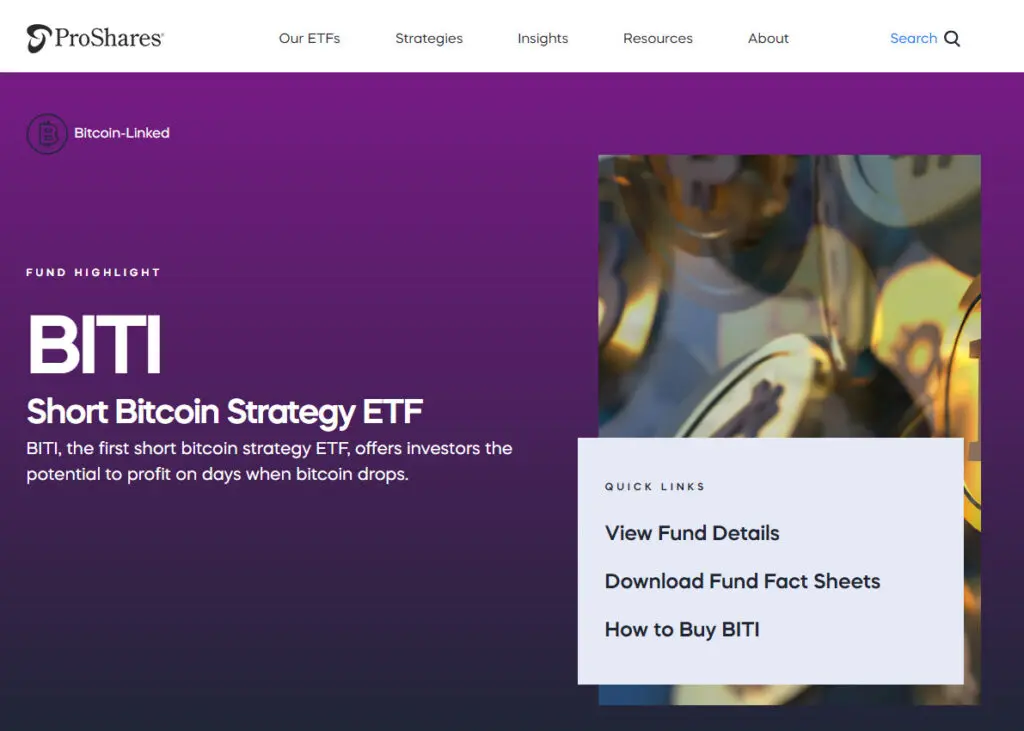

Factors Influencing the Decision to Buy BTC or ETH

Several key market indicators can influence a potential buyer's decision when considering an investment in BTC or ETH. Understanding these factors is crucial for making informed investment choices.

- Market Sentiment: General market sentiment can impact prices significantly. Positive news can drive prices up, while negative news can lead to sharp declines.

- Regulatory Developments: Changes in regulations can create uncertainty or confidence in the market, affecting investor behavior and pricing.

- Adoption Rates: Increased adoption of BTC and ETH across various sectors, whether by institutions or retail investors, often heralds price increases.

- Technological Developments: Upgrades and advancements in blockchain technology can enhance functionality and security, influencing investor sentiment.

The impact of regulatory news cannot be understated. For instance, announcements regarding government restrictions or acceptance of cryptocurrencies can lead to significant price fluctuations. Moreover, the overall market sentiment, shaped by news cycles, investor behavior, and economic factors, plays a pivotal role in price determination.Economic factors, including inflation rates and monetary policies, also influence the timing of purchases. Investors often look for signs of bullish or bearish trends in the broader financial landscape before making decisions on when to buy BTC or ETH.

Methods of Buying BTC and ETH

There are numerous platforms available for users to purchase BTC and ETH, with cryptocurrency exchanges being the most popular. Users can also acquire these cryptocurrencies through wallets that offer purchasing options.To purchase BTC or ETH on a cryptocurrency exchange, the following steps are typically involved:

- Create an account on the chosen exchange.

- Complete the verification process, which may include providing identification documents.

- Deposit funds into your account using a bank transfer or credit card.

- Navigate to the trading section and select BTC or ETH.

- Choose the amount to buy and place your order.

- Confirm the transaction and ensure the cryptocurrency is transferred to your wallet.

A comparison table of different exchanges can help potential buyers make informed choices based on fees, available currencies, and security features.

| Exchange | Fees | Available Currencies | Security Features |

|---|---|---|---|

| Exchange A | 0.2% | BTC, ETH, LTC | 2FA, Cold Storage |

| Exchange B | 0.1% | BTC, ETH, XRP | Insurance Fund, 2FA |

| Exchange C | 1% | BTC, ETH, ADA | Multi-Signature Wallets |

Storage Solutions for BTC and ETH

Once BTC and ETH are purchased, securing these assets is of utmost importance. There are various storage options available, each with its own advantages and disadvantages.

- Hot Wallets: These wallets are connected to the internet, making them convenient for frequent transactions. However, they are more vulnerable to hacking.

- Cold Wallets: Cold storage refers to wallets not connected to the internet, providing a higher level of security. They are ideal for long-term holding.

- Hardware Wallets: A type of cold wallet, hardware wallets provide a secure way to store cryptocurrencies offline. They are portable and are considered one of the safest options.

To securely store BTC and ETH after purchase, users should follow these guidelines:

- Use strong, unique passwords for wallets and exchanges.

- Enable two-factor authentication (2FA) wherever possible.

- Regularly update software wallets to the latest versions.

- Consider using a hardware wallet for significant holdings.

Choosing the right wallet depends on individual needs, including frequency of transactions and security considerations.

Risks Involved in Buying BTC and ETH

Investing in BTC and ETH carries inherent risks that potential buyers should be aware of before making any purchase.

- Market Volatility: Cryptocurrency prices can be highly volatile, leading to rapid gains or losses.

- Scams: The cryptocurrency market is rife with scams, including phishing attacks and Ponzi schemes. Awareness is key to avoiding these traps.

- Regulatory Risks: Changes in regulations can impact the value of cryptocurrencies and the legality of trading.

Market volatility can significantly affect investment decisions, as prices can fluctuate wildly within short periods. To avoid scams, investors should conduct thorough research, use reputable exchanges, and remain vigilant against suspicious offers or communications.

Long-term vs Short-term Investment Strategies for BTC and ETH

When considering investment strategies for BTC and ETH, investors can choose between long-term and short-term approaches. Each strategy has its own advantages and disadvantages.

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Long-term | Potential for significant appreciation; less affected by daily volatility. | Requires patience; potential for missing short-term gains. |

| Short-term | Opportunity for quick profits; takes advantage of market fluctuations. | Higher risk due to volatility; requires constant market monitoring. |

Successful investment strategies used by seasoned investors often involve a mix of both approaches, allowing them to capitalize on immediate opportunities while also securing long-term holdings.

Analyzing Market Trends for BTC and ETH

Effective investment in BTC and ETH requires a solid understanding of market trends. Investors can track price movements and trends through various methods.

- Price Charts: Utilizing price charts to observe historical trends and identify potential support and resistance levels.

- Technical Indicators: Employing indicators like the Moving Average (MA) or Relative Strength Index (RSI) to assess market conditions.

- Fundamental Analysis: Evaluating external factors, including news events and market developments, to gauge potential impacts on BTC and ETH.

Analytical tools and resources available for investors include online charting platforms, market news websites, and cryptocurrency analysis tools. A comprehensive understanding of both fundamental and technical analysis is essential for making informed decisions regarding BTC and ETH investments. This knowledge equips investors to better navigate the complexities of the cryptocurrency market.

Conclusion

In summary, the journey of btc eth buy encompasses understanding the core principles of Bitcoin and Ethereum, the methods of acquiring them, and the strategies for effectively managing your investments. As the market continues to shift, staying informed about trends, risks, and innovative storage solutions will be crucial in maximizing your investment potential. With the right knowledge and strategies, you can confidently engage in the exciting world of cryptocurrency.

FAQ Compilation

What is the difference between BTC and ETH?

BTC (Bitcoin) is primarily used as a digital currency, while ETH (Ethereum) serves as a platform for building decentralized applications and smart contracts.

How can I safely store my BTC and ETH?

You can store BTC and ETH in hot wallets for convenience or cold wallets and hardware wallets for enhanced security.

What are the risks of investing in BTC and ETH?

Investing in BTC and ETH carries risks such as market volatility, regulatory changes, and potential scams.

When is the best time to buy BTC and ETH?

The best time to buy often depends on market trends, economic factors, and personal investment strategies.

Can I earn passive income with BTC and ETH?

Yes, through methods like staking Ethereum or lending platforms, you can earn passive income on your crypto holdings.

.png)